Why is My Insurance Company Giving Me a Low Evaluation for My Car?

Being in a car accident is a troubling ordeal, and some would say that dealing with the insurance company is even more troubling. During the insurance claim process it is not uncommon for the affected parties to feel victimized by the system, especially when it comes to the evaluation of a totaled vehicle. The evaluation of a total loss is normally automatically instituted if the vehicle is more than approximately 65 percent damaged. However, whatever the total price, it will likely be far less than the anticipated value of the vehicle.

It is important that you further familiarize yourself with the intricacies of the evaluation process so that you may effectively amount a defense that will result in a more appropriate evaluation.

The Initial Determination

Determining damages is only the first step in the process. If the car is totaled, there is a separate, independent evaluation that takes place with the car in order to ensure fairness within the evaluation process. However, in this initial process, the adjuster will determine the condition of the vehicle so that they may also have defense if an evaluation is not in their favor. The insurance adjuster’s evaluation is determined by a myriad of conditions that issue the vehicle a rating that varies from poor to excellent, and their evaluation can carry an outsized effect on the process.

Additionally, because only brand new vehicles are rated ‘excellent’, this condition will never occupy an insurance adjuster’s evaluation of a used vehicle no matter how well the actual condition happens to be. So no matter how great you have taken care of your car, you can forget about an ‘excellent’ rating. Adjusters consider everything from interior floor coverings to the type of engine a vehicle is equipped with to determine the condition. This can also include issues like the trim package that the vehicle has, as well as features like the type of tires and even windows.

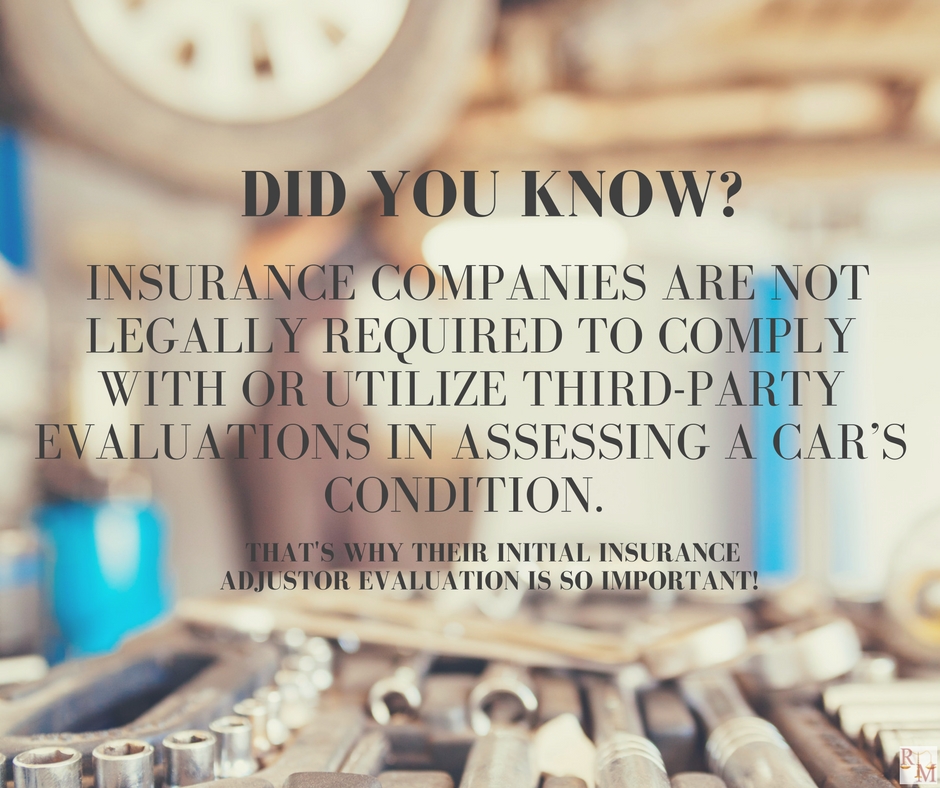

The Third Party Illusion

The system is designed to look as if there is a third party consideration based on fairness. This is only an illusion because the insurance company is bound by no legal statutes to comply with or to utilize the third-party evaluation in assessing the car’s condition. This is why their initial insurance adjuster evaluation is so important.

When the third party assessment designates a car’s condition based on much of the same characteristics that are included in the insurance adjuster’s evaluation, their report will be matched up with vehicle comparisons from car dealerships in the local area. The insurance company is then supposed to rectify their evaluation with the third party’s evaluation in order to produce the final evaluation. The only effective defense that a car owner has to increase this evaluation is to acquire equivalent values from local car companies themselves. It is best to receive these evaluations in writing from these companies. Additionally, car owners should always keep all maintenance schedules to prove that their vehicles are in a beneficial condition and well maintained before accepting their settlement. However, legal assistance may ultimately be necessary to effectively deal with all issues concerning the accident and the insurance companies.

If you’re in the process of dealing with the aftermath of an auto accident, it’s important to get advice you can trust. Call the Law offices of Robert L. Meissner today at (916) 473-1537 or fill out our online form for a complimentary consultation.